About HDFC Bank Limited:

In India, HDFC Bank is a well-known private sector bank with a stellar reputation. The bank’s stock is easily bought and sold on the stock market since it is highly liquid.

The bank was founded in August 1994 and offers a range of services, including asset management, credit cards, loans, retail and wholesale banking, and insurance.

Atanu Chakraborty serves as chairman, and Sashidhar Jagdishan serves as CEO. With almost 177,000 employees, HDFC Bank is renowned for its cutting-edge technology and excellent customer service.

The bank has been expanding recently, and in the upcoming years, it is expected to develop much more. Experts in the field state that by the end of 2023.

Risk Factors Affecting HDFC Bank Share Price Targets

A few risk factors that we might take into account with respect to the share prices of HDFC Banks and other banking companies are as follows:

- Financial crisis: credit cards, loans, insurance, and other financial items are all available at the bank. A slowdown in the economy could result in lower bank earnings and revenue, which would affect the share price.

- Competition: The bank’s market share and profitability may be impacted by the fierce competition in this industry.

- Modifications to Financial Rules: The country’s banking market share may be impacted by modifications to the financial rules, which could lead to a decline in the share price.

HDFC Bank Share Price Target, NSE: HDFC Bank Share price Targets, Future Prediction, Prognosis, Forecast 2024, 2025, 2026, 2027, 2028, 2029, 2030, 2031, 2035

The biggest bank in India’s private sector, HDFC Bank Limited, is a banking and financial services organisation with its headquarters located in Mumbai. Following the acquisition of its parent firm, HDFC Limited, HDFC Bank is now the second-largest listed corporation on the stock exchange and the fourth-largest bank globally in terms of market value.

HDFC Bank has the top spot in middle-market banking with a 60% market share and is the nation’s second-highest direct tax collector. Regarding financial networks, HDFC Bank stands among the biggest in India’s semi-urban and rural areas. Aside from this, it leads the auto loan market and is well-represented in the financing of passenger cars, trucks, and motorcycles.

In 1996, the Bombay Stock Exchange (BSE) floated HDFC Bank’s stock (BOM: 500180). HDFC Bank shares have done extremely well since listing, providing investors with strong returns thus far and the opportunity to continue doing so in the future. It won’t increase 100 times faster than you expect, but over time, it may quadruple your investment.

This post will provide you with an idea of the probable level of HDFC Bank’s share price in the upcoming years by showing you the stock projection for the company from now to the next 10 to 15 years. These price goals or projections are the result of a bespoke deep learning system that is constantly adjusted in response to changes in market cycles, volume movements, and price swings.

HDFC Bank Share Price Target in the upcoming years:

Regarding HDFC Bank’s projected stock price target, it may rise to ₹1,726.69 during the course of the next year. Its worth can rise to ₹2,144.32 if we project the next five years based on the current environment, and to ₹2,704.72 in the following ten years.

HDFC Bank Share Price Target 2024:

It is anticipated that HDFC Bank’s share price target will rise proportionately. It is one of the best banking stocks to buy since it is widely recognised as the best private-sector Indian bank and for its profitability.

It is anticipated by analysts that HDFC Bank will have a low price target of about ₹ 1,700 by March 2023 and a high price target of ₹ 1,900 in December 2024.

HDFC Bank Share Price Target 2025:

With a strong track record in the banking industry and a positive growth rate, HDFC Bank is a solid choice for future investments.

The share price is expected to peak in December, according to analysts, making it a potentially high-growth investment opportunity.

For those looking to invest in the Indian banking industry, HDFC Bank is a well-liked option due to its strong reputation and financial performance.

Minimum HDFC Bank Share Price Target of ₹ 2,000 and a maximum price objective of roughly ₹ 2,350 in 2025.

HDFC Bank Share Price Target 2026:

It is anticipated that HDFC Bank will have a prosperous future in 2025 due to its ongoing innovation and expansion of operations.

The company is well-established in the Indian banking industry and is expected to grow in the next few years.

Analysts expect that the stock will be worth ₹ 2,800 by 2026. Investors should keep in mind, however, that this objective is merely an estimate, and the real share price may differ.

HDFC Bank Share Price Target 2027:

As part of its ongoing effort to provide its customers with ever-better financial services, HDFC Bank has always been the first to implement new technologies into its operations.

We are able to stay informed from anywhere, and we are able to observe changes in our service dependent on the client, whether it is in digital payments or any kind of online banking facility.

If the HDFC Bank share price target is kept in mind until 2026, you could see the original aim of ₹ 3,000 while realising very large returns. You might anticipate seeing another target of ₹ 3,400 very soon after you accomplish this one.

HDFC Bank Share Price Target 2030:

Because of people’s trust in the bank, HDFC Bank is able to easily market its other products to customers, including credit card services, mutual funds, and insurance. The bank enjoys strong brand value in its business.

As a result, the bank seems to be quite successful in growing its business in all of these categories when compared to other banks.

Given the bank’s potential for long-term growth and its HDFC Bank Share Price Target 2030, it is likely that the share price will hover between ₹ 6,400 and ₹ 7,100.

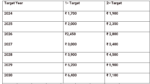

HDFC Share Price Target In Table:

Read More: HDFC Share Price Target

Read More: JP Power Share Price Target

Read More: RVNL Share Price Target

Read More: TATA Share Price Target

FAQs:

Can I buy HDFC Bank shares?

Blue-chip companies are good stocks because they usually have a good track record of financial performance and are less susceptible to market downturns.

What will HDFC Bank’s share price be in 2025?

HDFC Bank has set a target share price of Rs 2660.00 for 2025.

What will HDFC Bank’s share price be in 2030?

The projected value of HDFC Bank’s shares in 2030 is Rs 4565.00.

What will the HDFC Bank share price maximum objective be in 2023?

HDFC Bank’s target share price for 2023 is anticipated to be Rs 2037.00.

How can I buy stock in HDFC Bank?

There are numerous websites available where you can register for an account and start trading. However, among the greatest accounts is the HDFC Bank Demat and Trading Account.

What is the target share price for HDFC Bank between 2023 and 2030?

The 2023–2030 HDFC Bank share price targets are Rs 2037.00, Rs 2460.00, Rs 2660.00, Rs 2850.00, Rs 3685.00, and Rs 4565.00, in that order.

NOTE: Please note that SEBI has not given me permission to offer any financial advice or suggestions. Since share price prediction is not an exact science, as you are aware, I am utilising several AI technologies and undertaking extensive research in order to make my predictions. My sole aim is to provide knowledge, and I’m using AI to predict what the stock might do in the future.

Conclusion:

With respect to assets, HDFC Bank Ltd. is the biggest private sector lender in India. It is traded on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Its stock has performed well over the years, and following the merger of HDFC Bank and HDFC, improvements in the company’s financial position are anticipated.

According to analyst predictions, the shares of HDFC bank could rise to Rs. 3,795 by 2025. Investors should be aware that the actual share price may differ from this objective, which is merely an estimate.

Over the previous five years, HDFC Bank has demonstrated a noteworthy development in profits of 20.0% CAGR. Furthermore, throughout the same time frame, the bank showed robust sales growth of 15.0% CAGR. It has continuously produced strong quarterly results while operating at a solid profit. Additionally, the bank’s cash flow has been increasing, and as of March 2023, it had reached Rs. 41,330 Crore.

For a considerable amount of time, HDFC has been among the most profitable banks in India. For this reason, I think investing in HDFC Bank in 2023 is a wise move.

Disclaimer:The share price targets are all for informational purposes only. You should not consider any content on this website to be legal, financial, or investment advice of any kind. You should thoroughly investigate any firm you are considering investing in and make your own analysis. Since trading is a risky endeavour, please speak with a financial professional before making any decisions.