Friends, today we’re going to talk about the RVNL Share Price Target 2023, 2024, 2025, 2026, 2027, 2028, 2029, and 2030 through this article. We’ll also learn how the company’s fundamentals are doing and how it will be to invest in this company right now, as well as how much return this share can give to its investors in the future. So let’s learn and comprehend this business.

Rail Vikas Nigam Limited Company Details:

- Company name: Rail Vikas Nigam Limited (RVNL)

- Company type: Public limited company

- Incorporation date: 24 January 2003

A public-sector company, Rail Vikas Nigam Limited (RVNL), is governed administratively by the Indian government’s Ministry of Railways. Among its main activities are the creation and building of new railway lines, the doubling of existing lines, gauge conversion, railway electrification, workshops, metro projects, br

idges, etc. It is one of the biggest construction enterprises in India.

In recent times, RVNL has played a pivotal role in the advancement of India’s railway network. The Delhi Metro, the Mumbai-Ahmedabad High-Speed Rail Corridor, and the Dedicated Freight Corridors (DFCs) are just a few of the significant projects it has completed.

Rail Vikas Nigam Limited (RVNL) financials:

RVNL reported ₹14,783.10 crore in total revenue and ₹2,223.93 crore in profit after tax for the fiscal year 2022-2023.

Rail Vikas Nigam Limited (RVNL) management:

Shri G.C. Murmu is RVNL’s current chairman and managing director.

Rail Vikas Nigam Limited (RVNL) outlook:

With a healthy order book of more than ₹1.5 lakh crore, RVNL is predicted to keep expanding in the years to come. The government’s emphasis on infrastructure development presents an advantageous opportunity for the corporation.

Rail Vikas Nigam Limited (RVNL)

Business Model:

The Ministry of Railways uses Rail Vikas Nigam Limited (RVNL), a public sector company, to carry out project implementation and create transport infrastructure. RVNL’s business strategy is predicated on the following:

- Project management:

From conception to commissioning, RVNL manages the construction of railway infrastructure projects. This covers tasks like organizing , creating, building, and overseeing.

- Construction and engineering:

RVNL is capable of doing these tasks internally. This makes it possible for the business to carry out initiatives successfully and efficiently.

- Financial management:

The government, financial institutions, and multilateral organizations are some of the sources from which RVNL gathers funding. This enables the business to take on significant and challenging projects.

RVNL generates revenue from the following:

- Management fees: For the projects it works on, RVNL collects a management fee. Usually, the charge represents a portion of the overall project cost.

- Additional revenue: In addition to its rental income, RVNL also receives interest from its investments.

Because the government essentially guarantees the company’s revenue, RVNL’s business model is comparatively low-risk. Additionally, the business has a proven track record of profitability.

Advantages of RVNL’s business model:

- Government supports :Being a government-owned business, RVNL is entitled to several benefits, including financial assistance and first dibs on contract awards.

- Strong track record : RVNL possesses a robust history of completing projects punctually and economically.

- Diversified portfolio: By working on a diverse range of projects,

RVNL lowers its risk exposure to any one industry.

Challenges faced by RVNL:

- Competition: Competition for RVNL comes from both commercial and public sector businesses.

- Government bureaucracy: Government bureaucracy affects RVNL and can occasionally cause delays in project implementation.

- Land acquisition: Since RVNL needs to acquire significant tracts of land for its projects, land acquisition is one of its biggest challenges.

All things considered, RVNL has a solid business plan with several benefits. In the upcoming years, the government’s emphasis on infrastructure development will be advantageous to the industry.

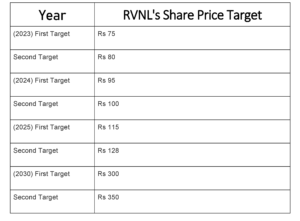

RVNL’s Share Price Target:

The target share price for Rail Vikas Nigam Limited (RVNL) in 2023 is be

tween ₹199 and ₹225. This is predicated on the business’s solid foundation, which includes its order book, financial results, and support from the government.

With an order book of more than ₹1.5 lakh crore, RVNL is likely to have a strong foundation for growth in the years to come. The government’s emphasis on developing infrastructure will also be advantageous to the corporation.

RVNL reported ₹14,783.10 crore in total revenue and ₹2,223.93 crore in profit after tax for the fiscal year 2022–2023. The past few years have seen a steady improvement in the company’s financial performance.

Being a government-owned business,

is entitled to several benefits, including financial assistance and first dibs on contract awards.In 2023, the share price of RVNL’s Share Price Target may rise even more, according to some analysts, contingent on the state of the market as a whole and the company’s performance.

It is crucial to remember that RVNL’s Share Price Target objectives are only projections and that historical performances do not guarantee future outcomes. Before making any investing selections, investors should always conduct independent research.

The following criteria form the basis of the 2024 share price target for Rail Vikas Nigam Limited (RVNL).

RVNL’s Share Price Target:

- Robust order book: With more than ₹1.5 lakh crore in outstanding orders, RVNL’s Share Price Target is projected to be able to sustain its expansion in the years to come.

- Government emphasis on infrastructure development: RVNL’s Share Price Target is expected to gain from the government’s prioritization of infrastructure development.

- Financial performance: Over the past few years, RVNL’s financial performance has consistently improved.

- Support from the government: As a government-owned business, RVNL is entitled to several benefits, including financial assistance and first dibs on contract awards.

In 2024, the share price of RVNL’s Share Price Target may rise even more, according to some analysts, contingent on the state of the market as a whole and the company’s performance.

It is crucial to remember that RVNL’s Share Price Target objectives are only projections and that historical performances do not guarantee future outcomes. Before making any investing selections, investors should always conduct independent research.

Here are some factors that could impact RVNL’s Share Price Target performance in 2024:

- The Indian stock market’s overall performance.

- The government’s emphasis on building infrastructure and its capacity to carry out initiatives on schedule and under budget.

- The ability of RVNL to complete projects on schedule and on budget.

- Any modifications to laws or rules that may have an effect on RVNL’s Share Price Target operations.

- Everything unfavorable that occurs in relation to RVNL or the Indian railway industry.

The following variables are used to determine the RVNL’s Share Price Target for in 2025:

RVNL’s Share Price Target:

- Robust order book: With more than ₹1.5 lakh crore in outstanding orders, RVNL is projected to be able to sustain its expansion in the years to come.

- Government emphasis on infrastructure development: RVNL’s Share Price Target is expected to gain from the government’s prioritization of infrastructure development.

- Financial performance: Over the past few years, RVNL’s financial performance has consistently improved.

- Support from the government: As a government-owned business, RVNL is entitled to several benefits, including financial assistance and first dibs on contract awards.

In 2025, the share price of RVNL may rise even more, according to some analysts, contingent on the state of the market as a whole and the company’s performance.

Here are some factors that could impact RVNL’s Share Price Target performance in 2025:

- The Indian stock market’s overall performance.

- The government’s emphasis on building infrastructure and its capacity to carry out initiatives on schedule and under budget.

- The ability of RVNL to complete projects on schedule and on budget.

- Any modifications to laws or rules that may have an effect on RVNL’s operations.

- Everything unfavorable that occurs in relation to RVNL or the Indian railway industry.

It is crucial to remember that share price objectives are only projections and that historical performances do not guarantee future outcomes. Before making any investing selections, investors should always conduct independent research.

In addition to the factors mentioned above, here are some other trends that could impact RVNL’s Share Price Target performance in 2025:

- The expansion of DFCs, or dedicated freight corridors.

- The construction of new railroad tracks as well as the doubling of current tracks.

- The National Rail Plan’s implementation.

- The expanding emphasis on environmentally friendly transportation.

RVNL is in a good position to gain from these developments. In India, the firm is a major force in the development and construction of railway infrastructure. It has an excellent history of completing projects on schedule and under budget. Additionally, RVNL receives government backing, which opens up a variety of benefits for it.

The RVNL’s Share Price Target for 2026 is based on the following factors:

RVNL’s Share Price Target:

- Robust order book: With more than ₹1.5 lakh crore in outstanding orders, RVNL is projected to be able to sustain its expansion in the years to come.

- Government emphasis on infrastructure development: RVNL’s Share Price Target is expected to benefit from the government’s prioritisation of infrastructure development.

- Financial performance: Over the past few years, RVNL’s Share Price Target performance has consistently improved.

- Support from the government: As a government-owned business, RVNL is entitled to several benefits, including financial assistance and first dibs on contract awards.

- Dedicated freight corridors (DFCs) are expanding.

- Construction of new railroad lines and the doubling of current ones.

- The National Rail Plan’s execution.

- Increasing attention is being paid to environmentally friendly transportation.

RVNL is in a good position to gain from these developments. In India, the firm is a major force in the development and construction of railway infrastructure. It has an excellent history of completing projects on schedule and under budget. Additionally, RVNL receives government backing, which opens up a variety of benefits for it.

It is crucial to remember that share price objectives are only projections and that historical performances do not guarantee future outcomes. Before making any investment selections, investors should always conduct independent research.

Here are some factors that could impact RVNL’s Share Price Target performance in 2026:

RVNL’s Share Price Target:

- The Indian stock market’s overall performance.

- The government’s emphasis on building infrastructure and its capacity to carry out initiatives on schedule and under budget.

- The ability of RVNL to complete projects on schedule and on budget.

- Any modifications to laws or rules that may have an effect on RVNL’s operations.

- Everything unfavourable that occurs in relation to RVNL or the Indian railway industry.

In general, RVNL is a solid business with a promising future. The government’s emphasis on building infrastructure and the rising demand for train travel in India present favourable opportunities for the corporation.

The RVNL’s Share Price Target for 2027 is based on the following factors:

- Robust order book: With more than ₹1.5 lakh crore in outstanding orders, RVNL is projected to be able to sustain its expansion in the years to come.

- Government emphasis on infrastructure development: RVNL is expected to gain from the government’s prioritisation of infrastructure development.

- Financial performance: Over the past few years,RVNL’s Share Price Target performance has consistently improved.

- Support from the government: As a government-owned business, RVNL is entitled to several benefits, including financial assistance and first dibs on contract awards.

- Dedicated freight corridors (DFCs) are expanding.

- Construction of new railroad lines and the doubling of current ones.

- The National Rail Plan’s execution.

- Increasing attention to environmentally friendly transportation.

In addition to the above factors, the following trends are also expected to impact RVNL’s Share Price Target performance in 2027:

- Growing demand from the freight and passenger groups for railroad transportation.

- The government’s emphasis is on creating cutting-edge rail technologies, namely semi-high-speed and high-speed rail.

- Increasing private sector investments in India’s railway industry.

RVNL’s Share Price Target is in a good position to gain from these developments. In India, the firm is a major force in the development and construction of railway infrastructure. It has an excellent history of completing projects on schedule and under budget. Additionally, RVNL receives government backing, which opens up a variety of benefits for it.

It is crucial to remember that share price objectives are only projections and that historical performances do not guarantee future outcomes. Before making any investment selections, investors should always conduct independent research.

The RVNL’s Share Price Target for 2030 is based on the following factors:

RVNL’s Share Price Target:

- Robust order book: With more than ₹1.5 lakh crore in outstanding orders, RVNL is projected to be able to sustain its expansion in the years to come.

- Government emphasis on infrastructure development: RVNL is expected to gain from the government’s prioritisation of infrastructure development.

- Financial performance: Over the past few years, RVNL’s Share Price Target performance has consistently improved.

- Support from the government: As a government-owned business, RVNL is entitled to several benefits, including financial assistance and first dibs on contract awards.

- Dedicated freight corridors (DFCs) are expanding.

- Construction of new railroad lines and the doubling of current ones.

- The National Rail Plan’s execution.

- Increasing attention is being paid to environmentally friendly transportation.

- Growing demand from the freight and passenger groups for railroad transportation.

- The government’s emphasis is on creating cutting-edge rail technologies, namely semi-high-speed and high-speed rail.

- Increasing private sector investments in India’s railway industry.

- There is growing emphasis in the railway industry on renewable energy and environmentally friendly transportation.

- There is rising demand from developing nations for railroad infrastructure.

- In the railway industry, there is a growing emphasis on automation and digitalization.

- Increasing expenditures on R&D for the railroad industry.

- In the railway industry, public-private partnerships (PPPs) are receiving more attention.

RVNL’s Share Price Target is in a good position to gain from each of these developments. The company has a proven track record of completing projects on schedule and within budget, making it a major player in the development and building of railway infrastructure in India. Additionally, RVNL receives government backing, which opens up a variety of benefits for it.

It is crucial to remember that share price objectives are only projections and that historical performances do not guarantee future outcomes. Before making any investment selections, investors should always conduct independent research.

Read More: RVNL Share Price Target

Read More: Suzlon Share Price Target

Read More: Tata Share Price Target

Read More : Happiest Minds Share Price Target

RVNL Share Price Target FAQ

Is RVNL a wise investment?

Over the last few years, RVNL has consistently increased its revenue and net profit, resulting in outstanding financial results. Over the past year, investors have received 460.29% gains from RVNL shares, which is a positive sign for the company’s financial health. It is ultimately up to you to decide whether or not to invest in RVNL.

Is RVNL debt free?

With ₹73.3 billion in shareholder equity and ₹64.4 billion in total debt, Rail Vikas Nigam has an 87.9% debt-to-equity ratio. The company has ₹184.2 billion in total assets and ₹111.0 billion in total liabilities. With an interest coverage ratio of 2.3, Rail Vikas Nigam’s Earnings Before Interest and Taxes (EBIT) is ₹12.9 billion.

After five years, what is the target share price for RVNL?

In the next five years, the price of RVNL’s stock could increase to ₹1,102.03.

After ten years, what is the target share price for RVNL?

In ten years, the price of RVNL’s stock might increase to ₹1,845.39.