Finolex Pipes Share Price Target 2023, 2024, 2025, 2026, 2027, 2030:

Finolex Pipes Company Details

One of India’s top producers of PVC, CPVC, and UPVC pipes and fittings is Finolex Pipes. Shri Pralhad P. Chhabria launched the business in 1981, and it has since developed into a reputable name in the plumbing sector.

Finolex Pipes is renowned for both its dedication to client happiness and its superior goods. The company uses the best raw materials and cutting-edge technology to make its products, which come with a robust warranty.

Finolex Pipes provides a large selection of goods for a range of uses, such as:

- Placing fixtures and pipelines for both business and residential structures

- agricultural irrigation and drainage pipes and fittings

- Industrial fittings and pipes for water and chemical treatment facilities

- Conducts for wiring and cabling electrical

Finolex Pipes Business Model

Finolex Pipes offers its goods to distributors and retailers, who resell them to final consumers as part of a business-to-business (B2B) business model. With more than 16,000 retail touch points and more than 600 distributors, the company boasts a robust network throughout India.

Finolex Pipes share price target also uses a cash-n-carry sales strategy, in which it makes cash sales of its goods to distributors. This lowers the company’s credit risk and helps it maintain a healthy cash flow.

The sale of PVC pipes and fittings is the main source of income for Finolex Pipes share price target. PVC is a common material in the industrial, plumbing, and agricultural industries because it is strong and adaptable. To fulfil the various needs of its clients, Finolex Pipes provides an extensive selection of PVC pipes and fittings.

Finolex Pipes also makes money from the sale of fittings and pipes made of UPVC and CPVC. Specialised PVC varieties called CPVC and UPVC are used in particular fields, like chemical handling and hot water plumbing.

The following fundamental components form the basis of Finolex Pipes’ business model:

1. High level of brand recognition: In the Indian plumbing sector, Finolex Pipes is a reputable and well-known brand. The company’s goods are renowned for their excellent quality and robustness.

2. Broad product selection: Finolex Pipes provides a large selection of goods for a range of uses. This enables the business to meet the wide range of needs that its clients have.

3. Robust distributor and retailer network: Finolex Pipes boasts a robust distributor and retailer network throughout India. This guarantees that end users may readily obtain the company’s products.

4. Cash-n-carry sales strategy: Finolex Pipes uses a cash-n-carry sales strategy to lower its credit risk and preserve a strong cash flow.

The business strategy of Finolex Pipes has been effective in positioning the company as one of India’s top producers of PVC, CPVC, and UPVC pipes and fittings.

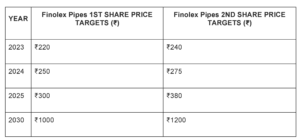

Finolex Pipes Share Price Target 2023:

The following variables determine the outlook for Finolex Pipes share price target:

Strong brand awareness and market dominance in the Indian PVC pipe and fittings market; broad product offering; and varied clientele robust distribution system, robust financial results

Investors should nevertheless be aware that there are a few hazards connected to buying Finolex pipes, such as:

- rivalry between producers of PVC pipes and fittings

- Price fluctuations for basic materials

- Economic downturn

Analysts are generally optimistic about Finolex Pipes share price target long-term prospects and think the business is well-positioned to gain from the expansion of the plumbing sector in India.

Conduct independent research: It’s crucial to conduct your own study and comprehend the financial standing and future prospects of Finolex Pipes before making an investment.

Keep your investments within your means of loss. There are no assurances, and the stock market is erratic. Don’t risk more money than you can afford to lose on the Finolex Pipes share price target.

Finolex Pipes Share Price Target 2024:

One of India’s top producers of PVC, CPVC, and UPVC pipes and fittings is Finolex Pipes. With a solid track record of expansion and financial success, the business is well-positioned to gain from India’s rising demand for PVC pipes and fittings.

The following variables determine the outlook for Finolex Pipes Share Price Target 2024:

Within the Indian PVC pipes and fittings market, Finolex Pipes enjoys a great level of brand awareness and leadership. Both the company’s clientele and its variety of products are diverse.

Throughout India, Finolex Pipes has a robust distribution network.

The business’s cash flows and margins are robust, and its financial performance is good.

In the upcoming years, demand for PVC pipes and fittings is probably going to be driven by the Indian government’s emphasis on infrastructure development.

Finolex Pipes should benefit from the increasing need for PVC pipes and fittings in the industrial and agricultural sectors.

pipes, such as

- rivalry between producers of PVC pipes and fittings

- Price fluctuations for basic materials

- Economic downturn

Conduct independent research: It’s crucial to conduct your own study and comprehend the financial standing and future prospects of Finolex Pipes before making an investment.

Keep your investments within your means of loss. There are no assurances, and the stock market is erratic. Don’t risk more money than you can afford to lose on the Finolex Pipes share price target.

Finolex Pipes Share Price Target 2025:

The following variables determine the outlook for Finolex Pipes share price target:

1. Strong brand awareness and market dominance in the Indian PVC pipe and fittings market; broad product offering; and varied clientele

robust distribution system throughout India

2. a sound financial performance with robust cash flows and margins

3. Concentrate on increasing output and product selection.

4. Intentions to break into new markets

5. Growing demand from the industrial, agricultural, and infrastructural sectors for PVC pipes and fittings

Investors should nevertheless be aware that there are a few hazards connected to buying Finolex Pipes shares price target price, such as:

1. Rivalry between producers of PVC pipes and fittings

2. Price fluctuations for basic materials

3.Economic downturn

4. Unfavourable government regulations

5. Conduct independent research: It’s crucial to conduct your own study and comprehend the financial standing and future prospects of Finolex Pipes before making an investment.

6. Keep your investments within your means of loss: There are no assurances, and the stock market is erratic. Don’t risk more money than you can afford to lose on the Finolex Pipes share price target.

Finolex Pipes Share Price Target 2030:

The following variables determine the outlook for Finolex Pipes Share Price Target:

1. High brand awareness and market dominance in the Indian PVC pipe and fittings market; broad product offering; and varied clientele

2. a robust Indian distribution network that is growing into new markets

3. a sound financial performance with robust cash flows and margins

4. Concentrate on increasing output and product selection.

5. Intentions to break into new markets

6. Growing demand from the industrial, agricultural, and infrastructural sectors for PVC pipes and fittings

7. The government’s emphasis on building infrastructure

9. Growing rates of urbanisation and disposable income

Investors should nevertheless be aware that there are a few hazards connected to buying Finolex Pipes, such as:

The Finolex Group is a well-known Indian conglomerate with a wide range of economic interests as of January 2022, when I last updated my information. Here are some essential facts regarding Finolex Group:

1. Business Overview: The Finolex Group is primarily focused on producing electrical and communications cables, but it also engages in other fields. Over the years, the corporation has added new industries to its portfolio of businesses, including electricity, lighting, and agriculture.

2. The group’s primary business, Finolex Cables Ltd., is one of the biggest producers of electrical and communication cables in India. The company manufactures a broad variety of cables for use in consumer goods, telecommunication, and power transfer.

3. Products and Services: Finolex Group produces a variety of goods in addition to cables.

3.1. Rivalry between producers of PVC pipes and fittings

3.2. Price fluctuations for basic materials

3.3.Economic downturn

3.4. Unfavourable government regulations

3.5. Disruptions brought about by technology

4. Agro-Products Division:The company’s agro-products division gives it a substantial foothold in the agriculture industry. Agriculture-related PVC pipe manufacturing is done by Finolex Agro Industries Limited.

5. Founders: P.P. Chhabria established the Finolex Group in 1958. The organisation has grown over the years, and the Chhabria family’s next generation is currently in charge of running it.

6. Corporate Social Responsibility (CSR):

The Finolex Group has a strong reputation for its dedication to CSR. They have started a number of projects aimed at promoting environmental sustainability, healthcare, education, and community development.

- READ MORE : TATA POWER SHARE PRICE TARGET

- READ MORE: RELIANCE COMMUNICATIONS SHARE PRICE TARGET

- READ MORE : FINOLEX SHARE PRICE TARGET

- READ MORE : IRCTC SHARE PRICE TARGET

- READ MORE : Happiest Mind Share Price Target

- READ MORE: Suzlon’s Share Price Target

Please be aware that since my last update in January 2022, some business data might have changed. For the most up-to-date and accurate information on Finolex Group and its different businesses, including its financial information, list of products, and

Disclaimer:

Greetings, esteemed readers. I want to remind you that SEBI (Securities and Exchange Board of India) has not given me permission to offer any recommendations or advice regarding money. This website contains updates and information that should only be used for educational and informative reasons. It is not meant to be a source of financial advice, stock recommendations, or investment advice. Even though it would be my pleasure, I disclaim all liability for any financial losses you could sustain as a result of the information provided on this page. But in the hopes of assisting you in making wise investing choices, I’m here to provide current updates on the stock market, cryptocurrencies, and financial products with a human touch.

1 thought on “Finolex Pipes Share Price Target 2024 ,2025,2026,2030 || Share Market Hindi”